O Que É Cfd Forex

A contract for difference is a fiscal derivative product that pays the divergence in settlement toll betwixt the opening and closing of a trade. CFDs are a tax efficient* (Britain) way of speculating on the financial markets and are highly pop amongst FX and bolt traders. CFD trading enables yous to speculate on the rising or falling prices of fast-moving global fiscal markets, such every bit forex, indices, commodities, shares and treasuries.

CFD pregnant

The meaning of CFD is 'contract for difference', which is a contract between an investor and an investment bank or spread betting firm, normally in the brusque-term. At the end of the contract, the parties exchange the difference between the opening and closing prices of a specified financial instrument, which tin can include forex, shares and commodities. Trading CFDs means that you tin can either brand a profit or loss, depending on which direction your chosen asset moves in.

What are contracts for divergence?

Contracts for difference are financial derivative products that let traders to speculate on short-term price movements. Some of the benefits of CFD trading are that you can trade on margin, and you can become brusk (sell) if you think prices will go down or go long (buy) if you think prices will rise. CFDs take many advantages and are revenue enhancement efficient in the Britain, significant that there is no stamp duty to pay. Delight note, tax handling depends on individual circumstances and can change or may differ in a jurisdiction other than the United kingdom of great britain and northern ireland. You tin can also use CFD trades to hedge an existing physical portfolio. With a CFD trading business relationship, our clients tin choose betwixt trading at home and on-the-go, as our platform is very flexible for traders of all backgrounds.

How does CFD trading work?

With CFD trading, you don't buy or sell the underlying asset (for example a physical share, currency pair or commodity). Instead, y'all buy or sell a number of units for a particular fiscal instrument, depending on whether y'all think prices will go up or downwardly. We offer CFDs on a broad range of global markets, covering currency pairs, stock indices, commodities, shares and treasuries. An example of one of our well-nigh pop stock indices is the UK 100, which aggregates the price movements of all the stocks listed on the UK'due south FTSE 100 index.

For every point the price of the instrument moves in your favour, y'all gain multiples of the number of CFD units y'all have bought or sold. For every point the price moves against you lot, you will make a loss.

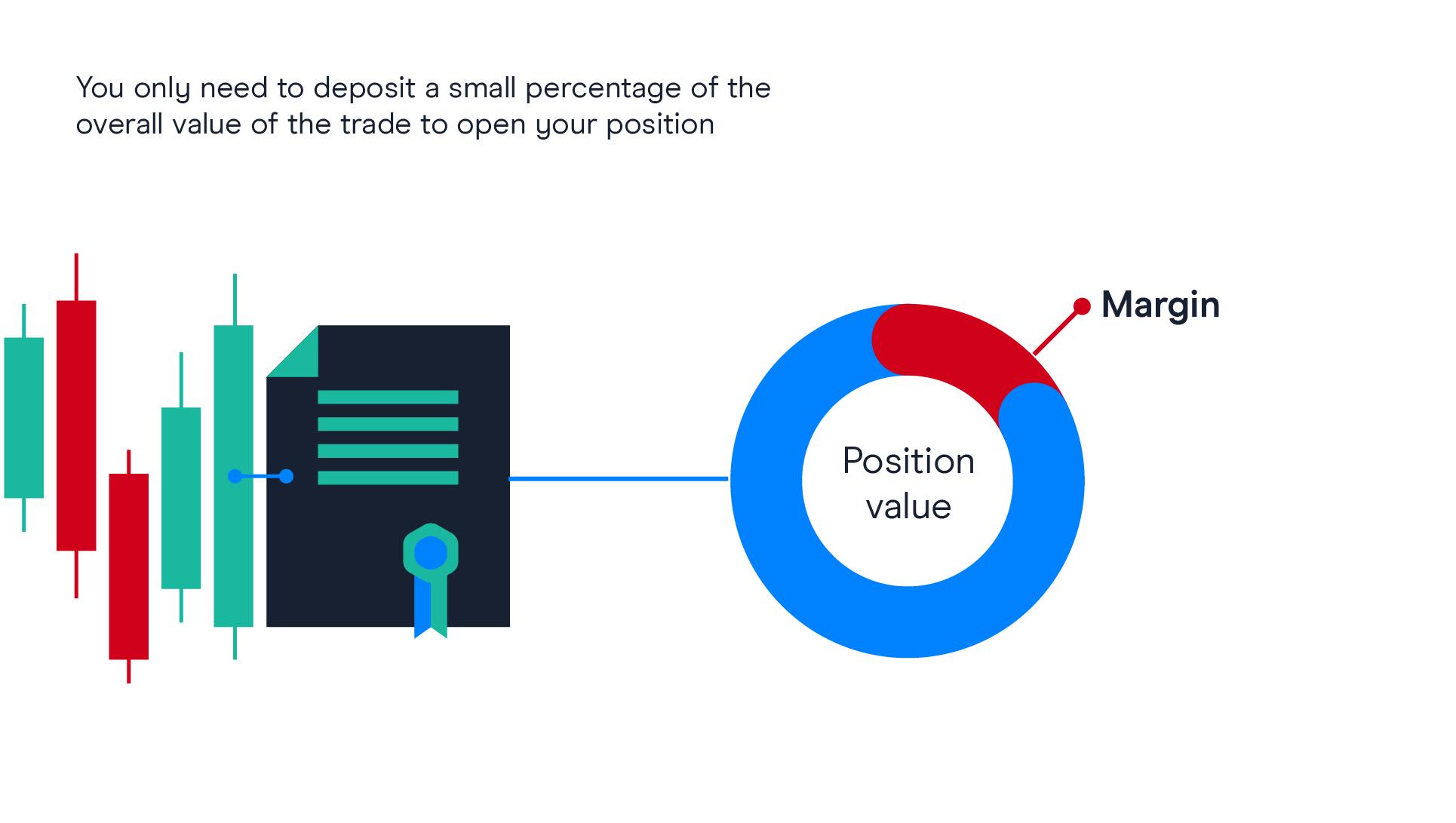

What is margin and leverage?

Contracts for departure (CFDs) is a leveraged product, which ways that you just demand to deposit a small percentage of the full value of the trade in society to open a position. This is chosen 'trading on margin' (or margin requirement). While trading on margin allows you to magnify your returns, your losses will as well be magnified as they are based on the full value of the position. This means that you could lose all of your majuscule, but equally the business relationship has negative balance protection, you can't lose more than your account value.

What are the costs of CFD trading?

Spread: When trading CFDs, you must pay the spread, which is the divergence between the purchase and sell price. You enter a buy trade using the buy price quoted and go out using the sell price. The narrower the spread, the less the price needs to move in your favour before you start to make a profit, or if the price moves against you, a loss. We offer consistently competitive spreads.

Holding costs: At the terminate of each trading solar day (at 5pm New York fourth dimension), whatever positions open in your account may be subject to a charge chosen a 'CFD holding cost'. The holding toll can be positive or negative depending on the direction of your position and the applicable holding rate.

Market information fees: To trade or view our toll information for share CFDs, you lot must activate the relevant market information subscription, for which a fee volition be charged. View our market data fees.

Commission (only applicable for shares): You must as well pay a separate committee charge when you merchandise share CFDs. Commission on U.k.-based shares on our CFD platform starts from 0.10% of the full exposure of the position, and there is a minimum commission charge of £9. View the examples below to see how to calculate commissions on share CFDs.

Example ane - Opening Trade

A 12,000 unit trade on United kingdom of great britain and northern ireland Visitor ABC at a price of 100p would incur a commission charge of £12 to enter the merchandise:

12,000 (units) x 100p (entry cost) = £12,000 x 0.10%

= £12

Example 2 - Opening Trade

A 5,000 unit trade on Great britain Company ABC at a cost of 100p would incur the minimum committee accuse of £9 to enter the trade:

5,000 (units) x 100p (entry price) = 5,000 x 0.x%

= £5.00 £9.00 (As this is less than the minimum commission charge for U.k. share CFDs, the minimum commission charge of £9 would be applied to this trade.)

Please notation: CFD trades incur a commission charge when the trade is opened besides as when it is closed. The in a higher place calculation can be practical for a closing merchandise; the only deviation is that you apply the exit price rather than the entry price. Learn more well-nigh CFD commissions and trading costs.

What instruments can I trade?

When y'all trade CFDs with us, you tin can accept a position on thousands of instruments. Our spreads start from 0.seven points on forex pairs including EUR/USD and AUD/USD. You can also trade the UK 100 and Germany 40 from ane bespeak and Gilt from 0.3 points. See our range of markets here. There is too the choice to merchandise CFDs over traditional share trading, which means that you do not have to have buying of the physical share.

Example of a CFD trade

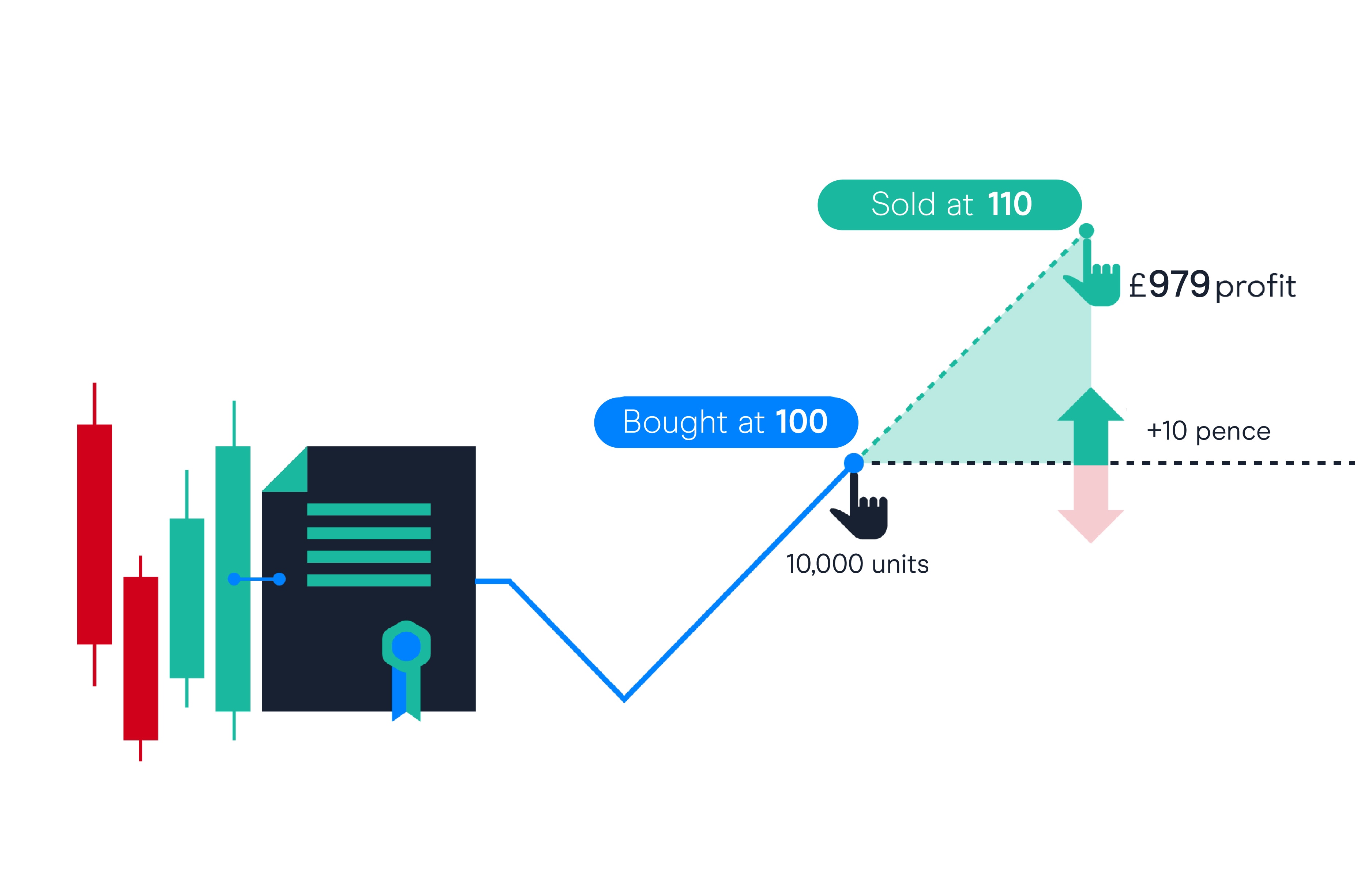

Ownership a visitor share in a rise marketplace (going long)

In this instance, UK Company ABC is trading at 98 / 100 (where 98 pence is the sell price and 100 pence is the buy price). The spread is 2.

You remember the company's price is going to get up so y'all decide to open a long position by ownership x,000 CFDs, or 'units' at 100 pence. A separate commission accuse of £10 would be applied when you open the merchandise, as 0.x% of the trade size is £ten (10,000 units x 100p = £10,000 x 0.10%).

Company ABC has a margin rate of iii%, which means you only take to eolith 3% of the total value of the trade as position margin. Therefore, in this instance your position margin will exist £300 (10,000 units 10 100p = £10,000 ten 3%).

Remember that if the cost moves against you, information technology's possible to lose more your margin of £300, as losses will be based on the full value of the position.

Outcome A: a assisting trade

Let's assume your prediction was correct and the price rises over the next calendar week to 110 / 112. You make up one's mind to shut your buy trade by selling at 110 pence (the current sell toll). Remember, committee is charged when you go out a merchandise likewise, so a accuse of £eleven would be applied when y'all close the trade, as 0.10% of the trade size is £xi (10,000 units 10 110p = £11,000 x 0.ten%).

The price has moved 10 pence in your favour, from 100 pence (the initial buy price or opening price) to 110 pence (the current sell price or closing price). Multiply this past the number of units you lot bought (10,000) to calculate your profit of £thousand, and then decrease the total commission charge (£10 at entry + £11 at exit = £21) which results in a full profit of £979.

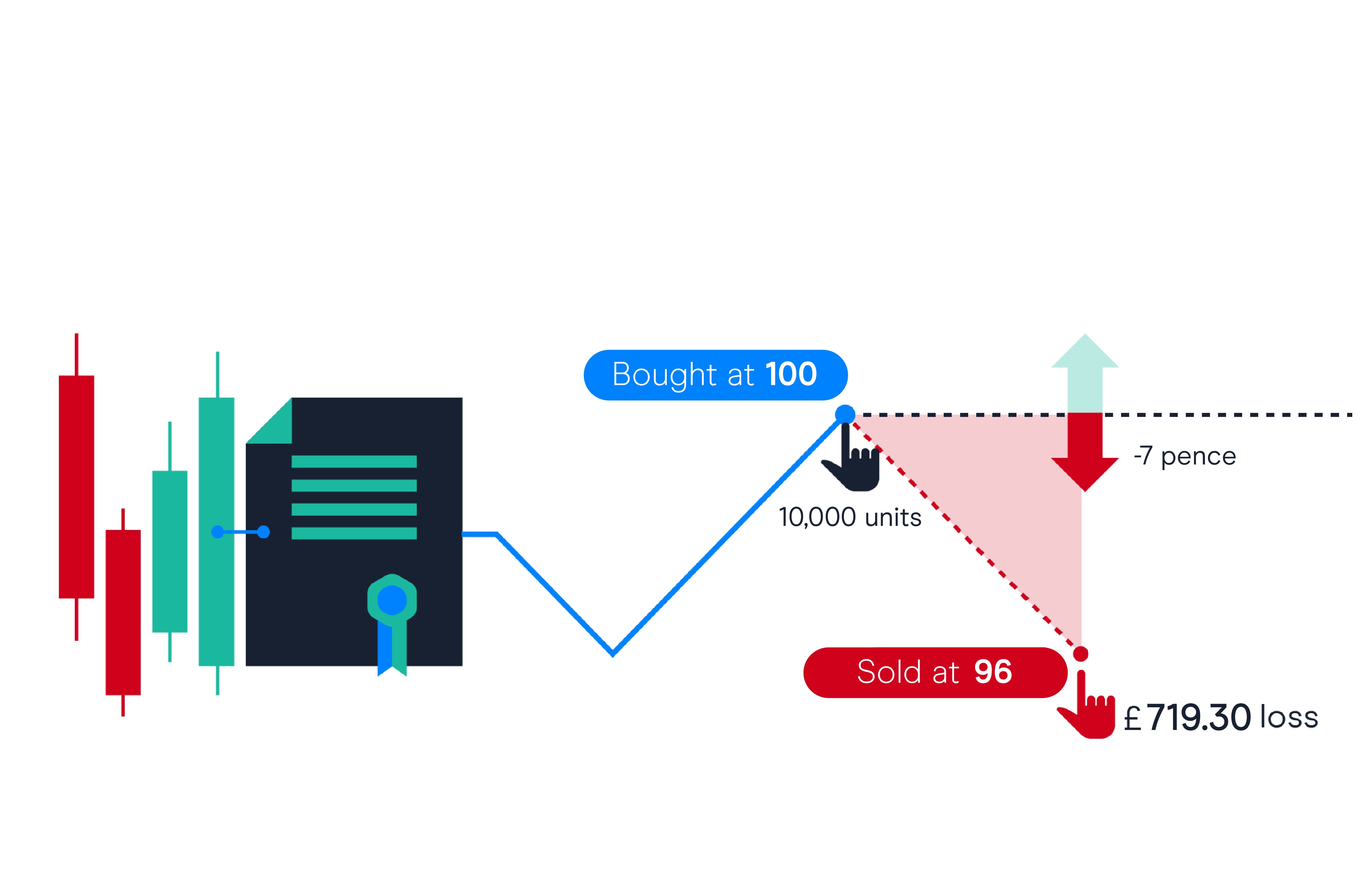

Outcome B: a losing trade

Unfortunately, your prediction was wrong and the cost of Company ABC drops over the next week to 93 / 95. You call up the price is probable to continue dropping so, to limit your losses, you lot decide to sell at 93 pence (the current sell price) to close the trade. Equally commission is charged when you leave a trade besides, a charge of £nine.thirty would use, every bit 0.10% of the trade size is £9.30 (10,000 units 10 93p = £ix,300 10 0.10%).

The price has moved 7 pence against y'all, from 100 pence (the initial purchase price) to 93 pence (the current sell price). Multiply this past the number of units you bought (10,000) to calculate your loss of £700, plus the total commission accuse (£10 at entry + £ix.30 at leave = £nineteen.30) which results in a full loss of £719.30.

- View more in-depth CFD trading examples.

- Learn how to trade CFDs by watching our in-depth CFD trading tutorial using the Next Generation trading platform.

Short-selling CFDs in a falling marketplace

CFD trading enables yous to sell (short) an musical instrument if you believe information technology will autumn in value, with the aim of profiting from the predicted downward price movement. If your prediction turns out to be right, y'all can purchase the instrument back at a lower price to make a profit. If you are incorrect and the value rises, you volition brand a loss. This loss tin can exceed your deposits.

Seamlessly open and close trades, rail your progress and prepare alerts

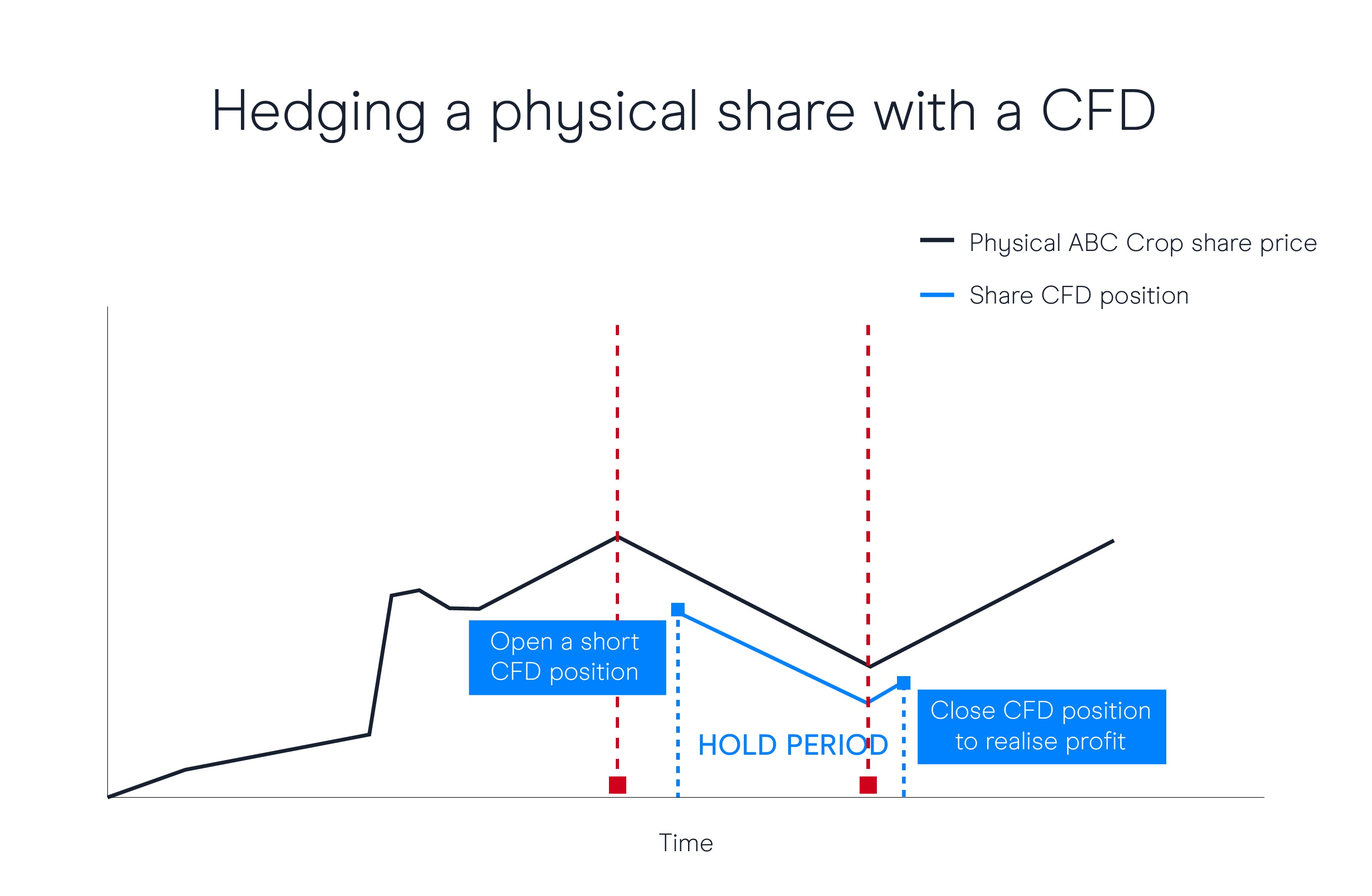

Hedging your physical portfolio with CFD trading

If you have already invested in an existing portfolio of physical shares with another broker and yous retrieve they may lose some of their value over the brusque term, you can utilize a CFD hedging strategy. By short selling the same shares every bit CFDs, you lot tin effort and make a profit from the short-term downtrend to offset any loss from your existing portfolio.

For example, say you hold £5000 worth of physical ABC Corp shares in your portfolio; you could agree a brusque position or short sell the equivalent value of ABC Corp with CFDs. And so, if ABC Corp's share price falls in the underlying market, the loss in value of your physical share portfolio could potentially be offset past the turn a profit fabricated on your short selling CFD trade. You could then close out your CFD merchandise to secure your turn a profit as the short-term downtrend comes to an cease and the value of your concrete shares starts to ascension once again.

Trading CFDs means that you can hedge physical share portfolios, which is a popular strategy for many investors, especially in volatile markets.

Source: https://www.cmcmarkets.com/en/learn-cfd-trading/what-are-cfds

Posted by: jenkinswasuff.blogspot.com

0 Response to "O Que É Cfd Forex"

Post a Comment